Offshore Trusts in Houston: What You Need to Know

Offshore Trusts in Houston: What You Need to Know

Blog Article

Understanding the Advantages and Difficulties of Developing an Offshore Trust Fund for Possession Protection

When considering possession security, establishing an offshore depend on might appear enticing. It uses privacy, prospective tax advantages, and a means to protect your properties from lenders. You'll require to navigate legal factors to consider and compliance concerns that differ across jurisdictions.

What Is an Offshore Trust?

An overseas trust fund is a legal plan where you move your properties to a count on that's established outside your home country. This setup permits you to manage and safeguard your riches in a jurisdiction with favorable laws. You can designate a trustee, who will look after the depend on according to your desires. By doing this, you're not only securing your assets but likewise possibly profiting from privacy and tax advantages fundamental in some overseas territories.

Key Benefits of Offshore Counts On for Property Security

When taking into consideration offshore trusts for possession defense, you'll locate a number of vital benefits that can profoundly influence your economic protection. These trusts offer boosted personal privacy, tax benefits, and a lawful shield from financial institutions. Recognizing these benefits can help you make educated decisions concerning your assets.

Improved Privacy Defense

Several individuals look for overseas trust funds not simply for economic advantages, but additionally for improved personal privacy defense. By developing an offshore trust fund, you can divide your personal possessions from your public identification, which can discourage undesirable interest and prospective legal cases. A lot of overseas jurisdictions supply strong privacy legislations, making it challenging for others to access your count on details. This included layer of privacy safeguards your monetary affairs from prying eyes, whether it's creditors, plaintiffs, or also snoopy neighbors. Additionally, you can keep greater control over how your properties are handled and distributed without disclosing sensitive information to the general public. Ultimately, an overseas count on can be an effective device for safeguarding your personal privacy while safeguarding your wealth.

Tax Advantages and Incentives

Beyond improved personal privacy protection, offshore counts on also supply significant tax obligation advantages and incentives that can additionally improve your financial technique. By developing an overseas trust fund, you might take pleasure in lowered tax obligation liabilities depending upon the territory you select. Numerous countries supply desirable tax prices or exceptions for trust funds, enabling your possessions to grow without the burden of excessive taxation. In addition, earnings generated within the count on could not be subject to regional taxes, protecting more riches for you and your beneficiaries. Additionally, certain offshore territories use rewards for foreign capitalists, making it less complicated for you to take full advantage of returns. In general, leveraging these tax obligation benefits can be a smart move in securing and growing your possessions efficiently (Offshore Trusts).

Legal Shield From Creditors

Establishing an offshore trust provides you a powerful lawful guard versus financial institutions, ensuring your properties stay secured in the face of financial challenges. By placing your possessions in an overseas depend on, you create an obstacle that makes it challenging for creditors to access them. Additionally, offshore counts on typically operate under various legal jurisdictions, which can provide additional benefits in possession security.

Legal Considerations When Developing an Offshore Trust Fund

When you're establishing an overseas trust, understanding the lawful landscape is important. You'll need to very carefully pick the ideal territory and assurance conformity with tax obligation regulations to protect your possessions effectively. Neglecting these variables can result in costly blunders down the line.

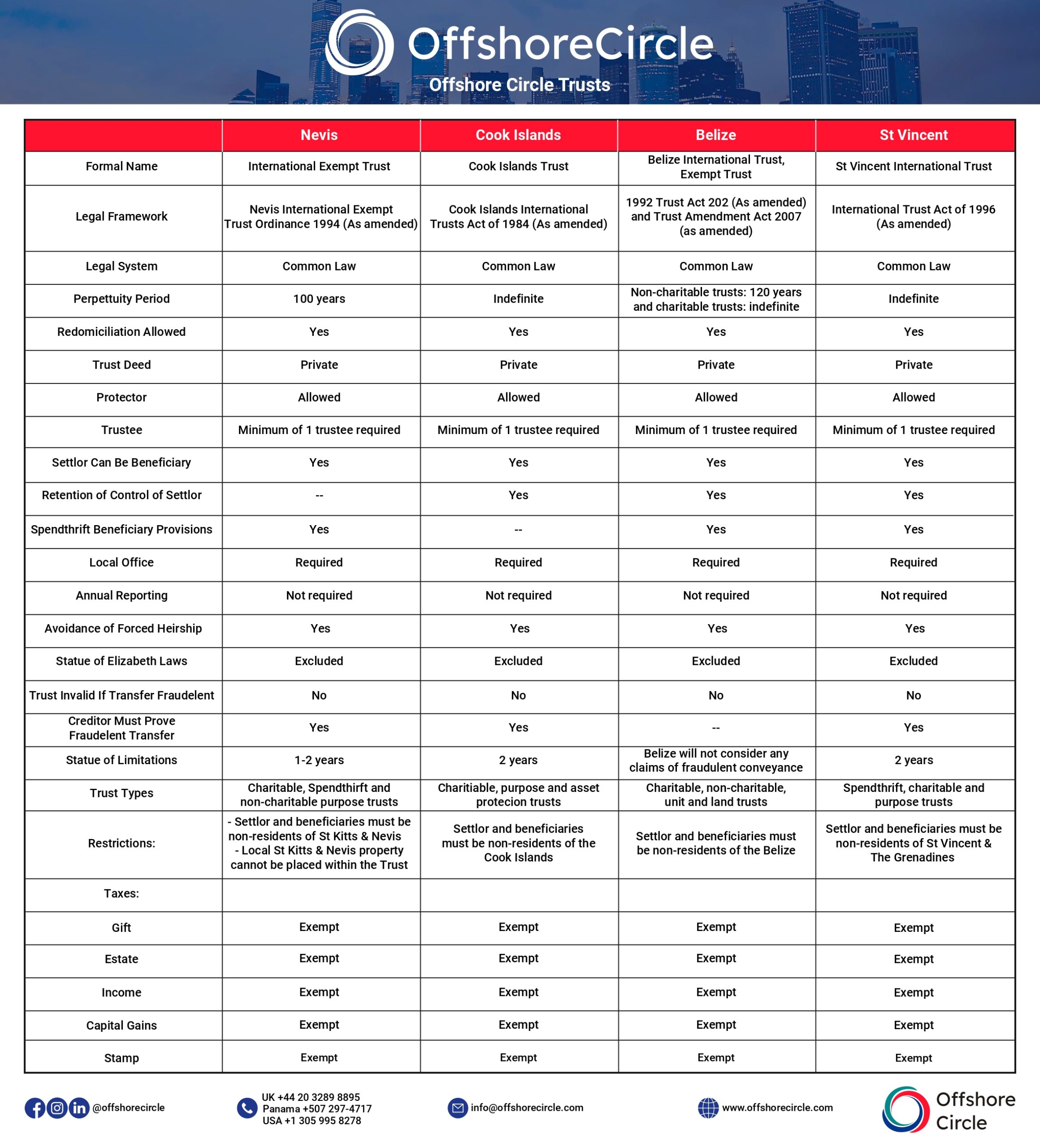

Territory Choice Standards

Selecting the right jurisdiction for your overseas depend on is essential, as it can significantly affect the effectiveness of your possession defense strategy. The simplicity of depend on facility and ongoing management additionally matters; some jurisdictions provide streamlined processes. Additionally, examine any personal privacy legislations that protect your details, as confidentiality is commonly a key motivator for picking an offshore trust.

Compliance With Tax Regulations

Understanding conformity with tax guidelines is essential for the success of your overseas trust. You'll need to familiarize yourself with both your home nation's tax laws and those of the overseas territory. Falling short to report your overseas count on can cause serious fines, consisting of large fines and possible criminal costs. Make specific you're submitting the needed types, like the internal revenue service Kind 3520, if you're an U.S. resident. click to find out more In addition, maintain complete records of depend on purchases and distributions. Consulting a tax professional that focuses on overseas counts on can aid you browse these complexities. By remaining certified, you can appreciate the benefits of possession protection without risking legal repercussions. Bear in mind, positive planning is crucial to keeping your count on's stability and performance.

Possible Tax Obligation Benefits of Offshore Counts On

While many people think about overseas trusts primarily for possession protection, they can also supply significant tax benefits. By positioning your possessions in an offshore count on, you could gain from a lot more beneficial tax obligation therapy than you would certainly receive in your house country. Many jurisdictions have reduced or zero tax obligation prices on income produced by properties kept in these trust funds, which can lead to considerable savings.

Furthermore, if you're a non-resident recipient, you may prevent certain local taxes totally. This can be specifically advantageous for those looking to protect riches across generations. Overseas trusts can give versatility in distributing income, possibly permitting you to time circulations for tax obligation performance.

Nevertheless, it's vital to talk to a tax expert acquainted with both your home nation's laws and the overseas territory's policies. Making the click to investigate most of these prospective tax obligation benefits requires mindful preparation and compliance to guarantee you remain within legal borders.

Obstacles and Dangers Linked With Offshore Trust Funds

Although overseas trust funds can supply countless advantages, they likewise come with a selection of obstacles and threats that you must very carefully consider. One considerable challenge is the intricacy of establishing and keeping the depend on. You'll need to navigate various legal and regulative requirements, which can be time-consuming and may need expert guidance.

Additionally, expenses can rise rapidly, from legal costs to ongoing management costs. It's likewise important to recognize that offshore counts on can attract scrutiny from tax obligation authorities. If not structured appropriately, you might encounter charges or increased tax liabilities.

Additionally, the possibility for modifications in regulations or political climates in the territory you have actually selected can posture risks. These modifications can influence your trust fund's efficiency and your accessibility to assets. Ultimately, while offshore trust funds can be beneficial, comprehending these obstacles is vital for making notified decisions concerning your property defense technique.

Choosing the Right Territory for Your Offshore Trust Fund

Exactly how do you choose the right jurisdiction for your offshore count on? Begin by considering the lawful framework and property security laws of potential jurisdictions. Search for areas recognized for strong personal privacy protections, like the Cook Islands or Nevis. more tips here You'll likewise intend to assess the jurisdiction's reputation; some are more reputable than others in the monetary globe.

Following, consider tax ramifications. Some territories use tax obligation advantages, while others might not be as positive. Offshore Trusts. Accessibility is an additional variable-- pick a place where you can conveniently communicate with trustees and legal professionals

Ultimately, consider the political and financial security of the territory. A steady environment warranties your assets are much less most likely to be affected by unexpected modifications. By thoroughly evaluating these elements, you'll be better outfitted to select the appropriate territory that aligns with your property protection goals.

Actions to Developing an Offshore Depend On Effectively

Developing an offshore trust fund effectively calls for cautious planning and a series of critical steps. First, you need to choose the appropriate jurisdiction based on your possession protection goals and legal demands. Research the tax obligation effects and personal privacy laws in possible areas.

Following, pick a respectable trustee that comprehends the nuances of offshore trust funds. He or she or establishment will certainly manage the trust and assurance compliance with neighborhood laws.

As soon as you have actually chosen a trustee, draft an extensive count on deed describing your purposes and the recipients involved. It's smart to consult with lawful and economic advisors throughout this process to verify whatever aligns with your objectives.

After settling the documentation, fund the trust by moving properties. Keep communication open with your trustee and examine the trust regularly to adjust to any adjustments in your situation or relevant laws. Following these steps faithfully will assist you develop your offshore trust successfully.

Regularly Asked Questions

Exactly how Much Does It Cost to Set up an Offshore Trust Fund?

Establishing an offshore trust generally costs between $5,000 and $20,000. Elements like intricacy, territory, and expert costs impact the overall price. You'll desire to budget plan for ongoing upkeep and legal costs also.

Can I Be Both the Trustee and Beneficiary?

Yes, you can be both the trustee and recipient of an offshore trust, but it's necessary to comprehend the legal implications. It may complicate property security, so think about getting in touch with a specialist for advice.

Are Offshore Trusts Legal for US People?

Yes, overseas trust funds are lawful for U.S. citizens. Nevertheless, you need to follow tax reporting demands and ensure the trust aligns with U.S. legislations. Consulting a legal expert is important to navigate the complexities involved.

What Takes place if My Offshore Count On Is Tested?

If your overseas trust is tested, a court might scrutinize its legitimacy, potentially leading to possession healing. You'll require to supply proof supporting its credibility and function to safeguard versus any type of insurance claims properly.

Just how Do I Choose a Trustee for My Offshore Trust?

Choosing a trustee for your overseas trust fund entails reviewing their experience, credibility, and understanding of your goals. Try to find somebody trustworthy and educated, and make sure they recognize with the legislations regulating overseas depends on.

Report this page